How to manage your budgets

After a while of creating transactions you may find the same type of transaction always recurring. Or alternatively you may want to reduce spending on certain type of transactions, or at the very least keep track that the spending does not increase dramatically.

These type of transactions can be grouped together in budgets, as they are recurring costs. For each budget you can allocate a specific amount of money every month. Pledger.io will then keep track of your expected and the actual expenses.

Getting started with budgets

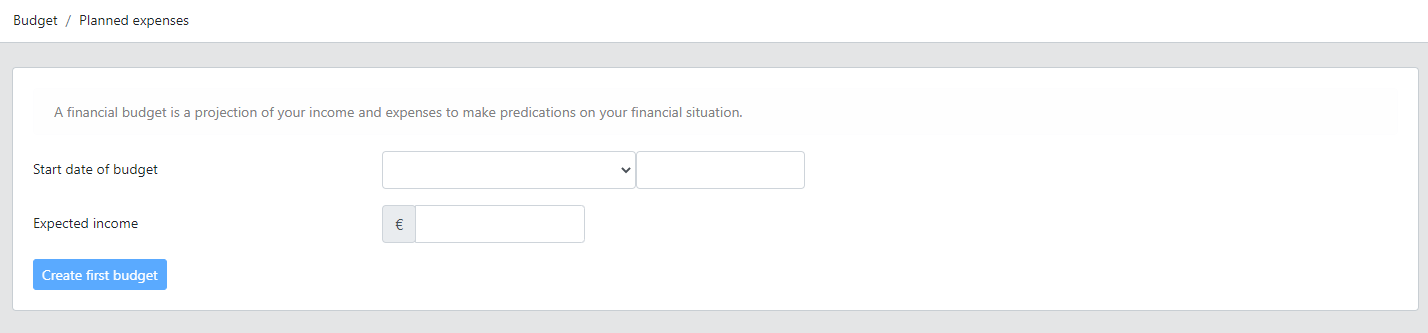

Upon visiting the budget overview page for the first time you will be asked to create your first budget. To do this you need to provide the month and year that the budget should begin, and your expected monthly net income. The net income is the amount of money your employer deposits in your bank account.

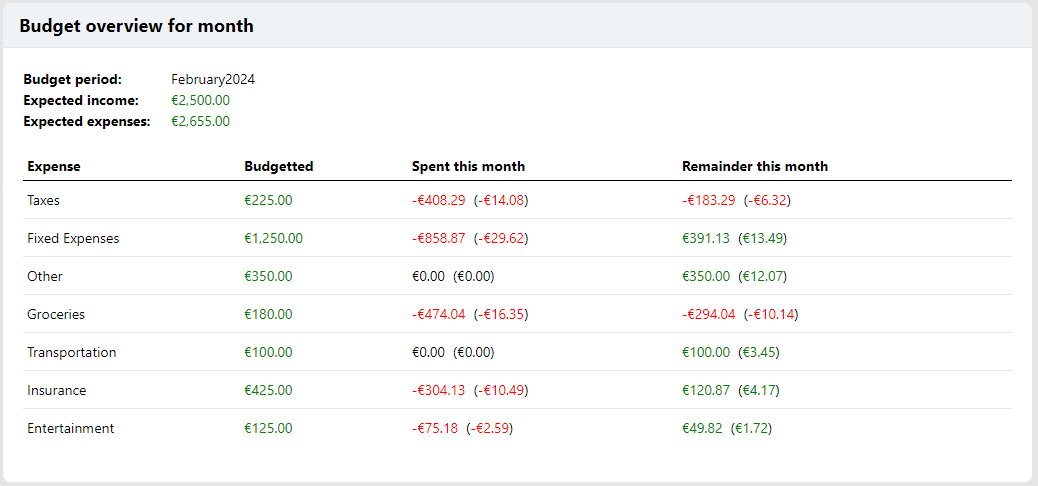

Once a budget exists you will see the budget overview. This is a monthly overview since the actual transaction amount is displayed linked to the budget.

Once a budget exists you will see the budget overview. This is a monthly overview since the actual transaction amount is displayed linked to the budget.

Adding expenses to a budget

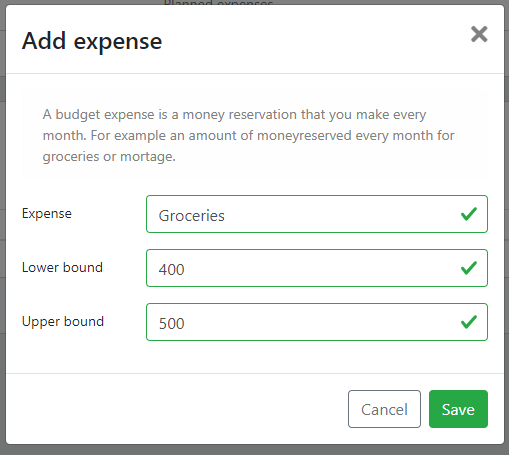

To start adding a new expected expense click the Add an expense button.

An expected expense is a label surrounding transactions.

An example is 'Bills' or 'Groceries'.

In the Add expense form you need to provide the label for the expected expense, and a lower and upper bound.

During the year you may notice that your expense habits or income has changed. Once this happens you should update your budget to reflect the changes.